Studies

Knowledge hub for sustainable timber carbon investments

We document where the international debate stands (selection).

Studien

29 January 2024

Interim report DeCIRRA

Interim report of sub-project 3 (SP3) of the Innosuisse flagship project DeCIRRA (Decarbonization of CIties and Regions with Renewable gAses). SP3 aims to make a contribution to the decarbonization of Switzerland, in particular on the topic of Carbon Dioxide Removal (CDR) and Negative Emission Technologies (NET) as well as Carbon Capture and Storage (CCS) and the material use of captured CO2 in products (CCU).

29 January 2024

Zwischenbericht DeCIRRA

Zwischenbericht des Sub-Projektes 3 (SP3) des Innosuisse Flagship Projektes DeCIRRA (Decarbonisation of CIties and Regions with Renewable gAses). Das SP3 will einen Beitrag leisten zur Dekarbonisierung der Schweiz, im Speziellen zum Thema Carbon Dioxide Removal (CDR) bzw. Negativemissionstechnologien (NET) sowie Carbon Capture and Storage (CCS) und die stoffliche Nutzung von Abgefangenem CO2 in Produkten (CCU).

22 November 2023

SBTi Monitoring Report 2022

The science based targets initiative (SBTI) drives ambitious corporate climate action by enabling businesses and financial institutions globally to set science-based greenhouse gas (GHG) emissions reduction targets.

Published August 2023

7 September 2023

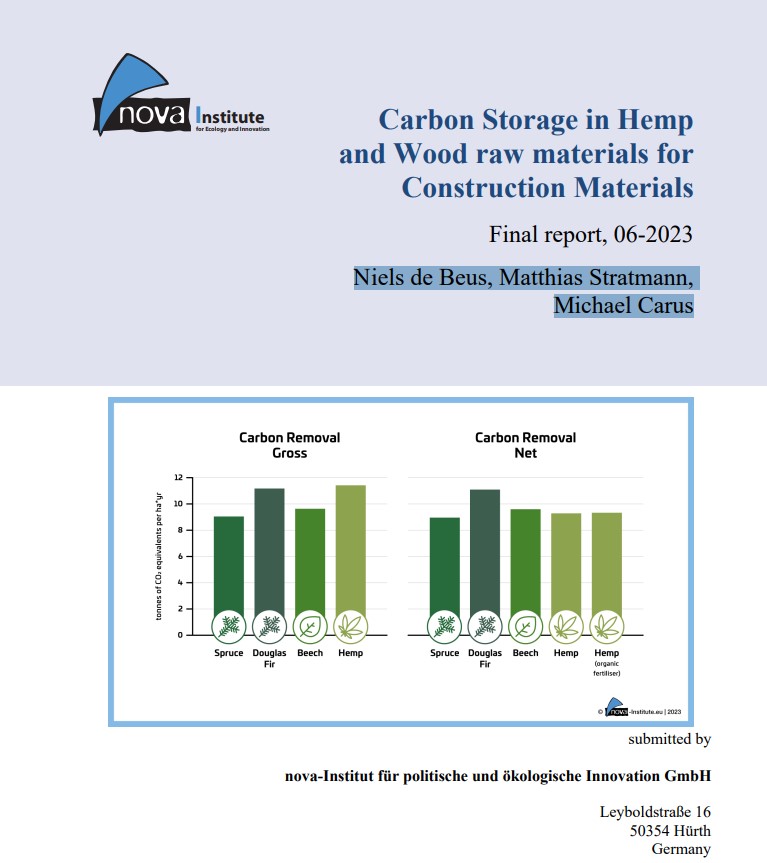

Carbon Storage in Hemp and Wood raw materials for Construction Materials

nova-Institut für politische und ökologische Innovation GmbH

21 June 2023

Whole Life Carbon Impact of: 45 Timber Buildings

Sustainable buildings are increasingly a key concern, especially when it comes

to reducing their climate footprints. This has resulted in the 2023 Building Regulations introducing requirements for the environmental impact of buildings.

Wissensplattform zu nachhaltigen Timber Carbon Investments

Wissensplattform zu nachhaltigen Timber Carbon Investments

Wir dokumentieren, wo die internationale Debatte steht (Auswahl).

- Copyright 2024 Timber Finance

- Imprint

- Privacy Policy

Important Legal Notice

Important Legal Notice

The official website of The Timber Finance Management AG (hereinafter referred to as TFM) contains, among other things, information and opinions on investment instruments, products and services (hereinafter referred to collectively as financial products). You can therefore only visit the website if you carefully read and subsequently accept the following important legal information for financial products. With your consent and your access to the website, you declare that you have understood and expressly agree to the legal information. TFM may involve third parties in the operation of the website. The following content also applies mutatis mutandis to information that customers receive, for example in the form of subscribed newsletters. The information as well as the rules of use can be updated at any time. The changes are binding. By the further use of the website and our services we proceed from your knowledge and your agreement.

Local legal restrictions

The website contains information and opinions on financial products (e.g. investment funds) which may be subject to different registration requirements in other countries. It is not directed at natural or legal persons for whom the use of or access to the TFM website would be contrary to the legal system of their country due to the nationality or domicile/registered office of the person concerned or for other reasons. This applies in particular to citizens and/or residents of Great Britain, Japan and the USA.

No recommendation or offer

The published contents constitute neither a recommendation nor an offer to purchase, hold or sell the financial products mentioned or to engage in other transactions or legal transactions. They are for personal use and information purposes only and may be changed at any time without prior notice by TFM, as may these legal notices for financial products. The contents provided in the section on financial products are not recommendations for your investment and other decisions and have no advisory character. Before investing in a financial product, the investor must have carefully read the current legal documents and all other documents that may be required by local legal and regulatory regulations (e.g. prospectus and annual and semi-annual report of an investment fund). It is particularly important to study the legal and risk information contained therein in detail. Before making an investment decision, it is also advisable to consult a specialist.

No warranty

TFM takes the greatest possible care in compiling the contents of its financial products. TFM and its contractual partners do not assume any guarantee or liability vis-a-vis third parties with regard to the correctness, up-to-dateness and completeness of the published content. In particular, TFM is under no obligation to update the content or remove obsolete content. TFM also assumes no responsibility and gives no guarantee that the functions of the website with content on the financial products will not be interrupted or error-free, that errors will be rectified or that the website or the respective server is free of viruses or other harmful components and programs. Furthermore, there may be links on the TFM website that lead to third-party websites. These links are completely beyond the control of TFM. TFM therefore accepts no responsibility whatsoever for the accuracy, completeness and legality of the content of such websites or for any offers and services contained therein. The Internet is an open network accessible to everyone and is therefore not considered a safe environment. TFM therefore accepts no liability whatsoever for the security of data transmitted via the Internet.

Risk notice

As a rule, the higher the risk (price fluctuations), the longer the investment period should be, and the higher the return opportunities. The value of the invested capital as well as the resulting income (e.g. distributions in connection with investment funds) are subject to fluctuations or can be completely eliminated. Investments in foreign currencies are subject to direct and indirect exchange rate fluctuations. Individual financial products are generally subject to higher risks.

Performance

A positive performance (performance) in the past is no guarantee for a positive performance in the future. TFM and its counterparties therefore cannot guarantee that the capital invested will maintain (or even increase) its value, and investors must be willing or able to accept any substantial losses or even total losses. When calculating performance, any fees and costs (e.g. commissions and costs charged on the subscription and redemption of fund units) levied on the purchase, holding or sale of the financial product are not taken into account.

Exclusion of liability

To the extent permitted by law, TFM and its contracting partners disclaim all liability (including negligence and liability towards third parties) for any loss arising directly, indirectly or consequentially from any kind of damage connected with the use of the website and its contents or with the risks of the financial markets. Access to and use of the Website is not guaranteed.

Ownership rights

All contents of this website are protected by copyright and are the property of TFM, unless expressly stated otherwise. No part of this website grants any license or right to use images, texts, trademarks or logos. Downloading or copying the website does not transfer any legal claims to the software or material contained therein. Any complete or partial reproduction, transmission, use or further publication of the contents of this website requires the written consent of TFM as well as the express indication of the source.

Applicable law/jurisdiction

Access to and use of the TFM website and this important legal information for financial products are subject to Swiss law. The exclusive place of jurisdiction is Zurich, Switzerland.