Author: Stefano Charrey

The Timber Finance Carbon Capture and Storage Index was rebalanced with effective date 3rd of April 2023, in line with the semi-annual rebalancing cycle. The rebalancing was characterized by certain index components entering and exiting the index, for the following reasons:

- General market developments, such as decreased trading activity

- Changes to the Index guidelines, which are discussed in detail below

- More stringent qualitative requirements applied to construction companies.

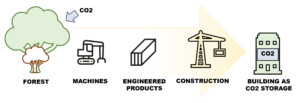

The Timber Finance Carbon Capture and Storage Index differentiates itself from other timber-related equity indices through its focus on the entire timber value chain of durable wood products used in construction. These products enable the long-term storage of carbon after it was absorbed by trees (carbon sequestration, which is made possible through photosynthesis). As a result, the index invests in companies ranging from forest owners (such as Timberland REITs) to real estate developers and construction companies who deploy engineered wood products in the Built Environment.

Evolution of the index guidelines

During the 1st quarter 2023, the index guidelines were amended to improve the robustness of the index’s weighting methodology, more formally recognize the contribution of forest owners to the process of absorbing and storing CO2 and increase the requirements with respect to acceptable wood certifications. Our aim is to provide consistency to the index guidelines, while ensuring that the index remains relevant and robust.

Index weights: a cap on qualitative index components was added and set to 20%, meaning that the stocks included in the index based on a qualitative assessment cannot cumulatively represent more than 20% of the index. This effectively limits the influence of discretionary inclusions in the index and ensures that the majority of the index can be backed by transparent quantitative criteria, while maintaining the qualitative stock selection as a pragmatic tool in order to incorporate the entire timber value chain. Stocks are now equally weighted within the quantitative and qualitative groups and are no longer dependent on index classifications that vary from one sector classification provider to another.

Forest assets: a new quantitative criterion for forest assets has been introduced. As a result, companies with forest assets representing more than 30% of their total assets are added to the quantitative pool. The environmental value of durable wood products originates from the forest’s sequestration capacity and therefore, companies with significant forest holdings should be included in the quantitative pool.

Certification requirements: a deeper level of detail has been added with regards to the type and extent of certifications required from companies who own forests and/or manufacture wood products. Instead of the previous generic 70% certification requirement, we introduced a requirement for either 1) reported 60% wood certified according to the established wood production standards (including Controlled Wood) and/or 2) an estimated 80% of supply going through a chain of custody standard.

Controlled Wood [link] standards require companies to implement measures to mitigate the risk that uncertified wood is sourced from, among others, illegally harvested forests.

Chain of Custody [link] certification verifies that certified material is identified and separated from unacceptable material.

Forest Management [link] certification verifies compliance with multiple criteria for sustainable forestry.

This amendment ensures companies who put significant effort into obtaining certifications across their entire timber supply chain are recognized for this and as the industry evolves and strengthens its sustainability credentials. These efforts are an important and necessary step in addressing illegal logging and deforestation. While chain-of-custody does not guarantee a minimum level of certified wood in the end-products, it is an essential step towards making the end-product certification possible, hence it can be seen as a positive contribution towards transparency, which is a necessary condition for sustainability. As part of the index review, one company was removed due to insufficient transparency on their product and supply-chain certification level.

Construction companies and SBTi commitments

Despite the changes in the index composition, the underlying concept of mapping the entire forest-to-frame timber value chain and focusing on the long-term storage of carbon in the Built Environment remained. We removed one engineering and three construction companies from the index as they did not meet our sustainability criteria. We expected a stronger and quicker evolution towards environmental commitments, specifically through an explicit commitment to the Science Based Targets Initiative (SBTi), in addition to an explicit contribution to the advancement of timber construction.

While not having an official SBTi commitment does not mean that a business does not care about the environment, having such a commitment (or even having the targets already validated by SBTi), strengthens the company’s position and increases the confidence for investors that the business is developing (or already has) a clear environmental sustainability strategy.

For additional information, please refer to the index rebalancing report here.